United Parcel Service (NYSE:UPS) underwent analysis by 12 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish. The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 2 | 5 | 1 | 0 |

| Last 30D | 0 | 1 | 2 | 1 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 1 | 3 | 0 | 0 |

| 3M Ago | 2 | 0 | 0 | 0 | 0 |

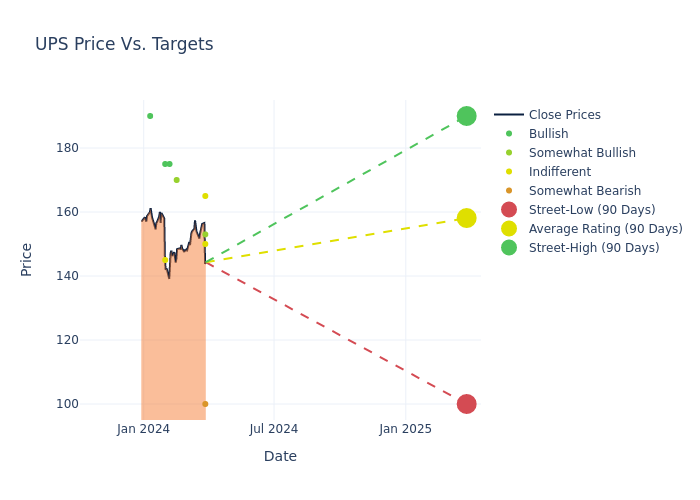

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $159.83, with a high estimate of $190.00 and a low estimate of $100.00. Marking an increase of 1.59%, the current average surpasses the previous average price target of $157.33.

A clear picture of United Parcel Service's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Bascome Majors | Susquehanna | Maintains | Neutral | $150.00 | $150.00 |

| Ravi Shanker | Morgan Stanley | Raises | Underweight | $100.00 | $95.00 |

| Fadi Chamoun | BMO Capital | Raises | Market Perform | $165.00 | $160.00 |

| Scott Schneeberger | Oppenheimer | Maintains | Outperform | $153.00 | $153.00 |

| Benjamin Hartford | Baird | Raises | Outperform | $170.00 | $165.00 |

| Thomas Wadewitz | UBS | Raises | Buy | $175.00 | $160.00 |

| Patrick Tyler Brown | Raymond James | Lowers | Strong Buy | $175.00 | $185.00 |

| Fadi Chamoun | BMO Capital | Lowers | Market Perform | $160.00 | $165.00 |

| Bascome Majors | Susquehanna | Lowers | Neutral | $150.00 | $155.00 |

| Brandon Oglenski | Barclays | Lowers | Equal-Weight | $145.00 | $150.00 |

| Patrick Tyler Brown | Raymond James | Raises | Strong Buy | $185.00 | $170.00 |

| J. Bruce Chan | Stifel | Raises | Buy | $190.00 | $180.00 |

Capture valuable insights into United Parcel Service's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on United Parcel Service analyst ratings.

As the world's largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS' domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder. UPS is currently pursuing "strategic alternatives" for its truck brokerage unit, Coyote, which it acquired in 2015.

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Negative Revenue Trend: Examining United Parcel Service's financials over 3 months reveals challenges. As of 31 December, 2023, the company experienced a decline of approximately -7.83% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 6.44%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): United Parcel Service's ROE excels beyond industry benchmarks, reaching 8.8%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.27%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 1.54, United Parcel Service adopts a prudent financial strategy, indicating a balanced approach to debt management.

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.