Bank Reconciliation

Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

What is a Bank Reconciliation?

A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Reconciling the two accounts helps identify whether accounting changes are needed. Bank reconciliations are completed at regular intervals to ensure that the company’s cash records are correct. They also help detect fraud and any cash manipulations.

Reasons for Difference Between Bank Statement and Company’s Accounting Record

When banks send companies a bank statement that contains the company’s beginning cash balance, transactions during the period, and ending cash balance, the bank’s ending cash balance and the company’s ending cash balance are almost always different. Some reasons for the difference are:

- Deposits in transit: Cash and checks that have been received and recorded by the company but have not yet been recorded on the bank statement.

- Outstanding checks: Checks that have been issued by the company to creditors but the payments have not yet been processed.

- Bank service fees: Banks deduct charges for services they provide to customers but these amounts are usually relatively small.

- Interest income: Banks pay interest on some bank accounts.

- Not sufficient funds (NSF) checks: When a customer deposits a check into an account but the account of the issuer of the check has an insufficient amount to pay the check, the bank deducts from the customer’s account the check that was previously credited. The check is then returned to the depositor as an NSF check.

Nowadays, many companies use specialized accounting software in bank reconciliation to reduce the amount of work and adjustments required and to enable real-time updates.

Bank Reconciliation Procedure

- On the bank statement, compare the company’s list of issued checks and deposits to the checks shown on the statement to identify uncleared checks and deposits in transit.

- Using the cash balance shown on the bank statement, add back any deposits in transit.

- Deduct any outstanding checks.

- This will provide the adjusted bank cash balance.

- Next, use the company’s ending cash balance, add any interest earned and notes receivable amount.

- Deduct any bank service fees, penalties, and NSF checks. This will arrive at the adjusted company cash balance.

- After reconciliation, the adjusted bank balance should match with the company’s ending adjusted cash balance.

Example

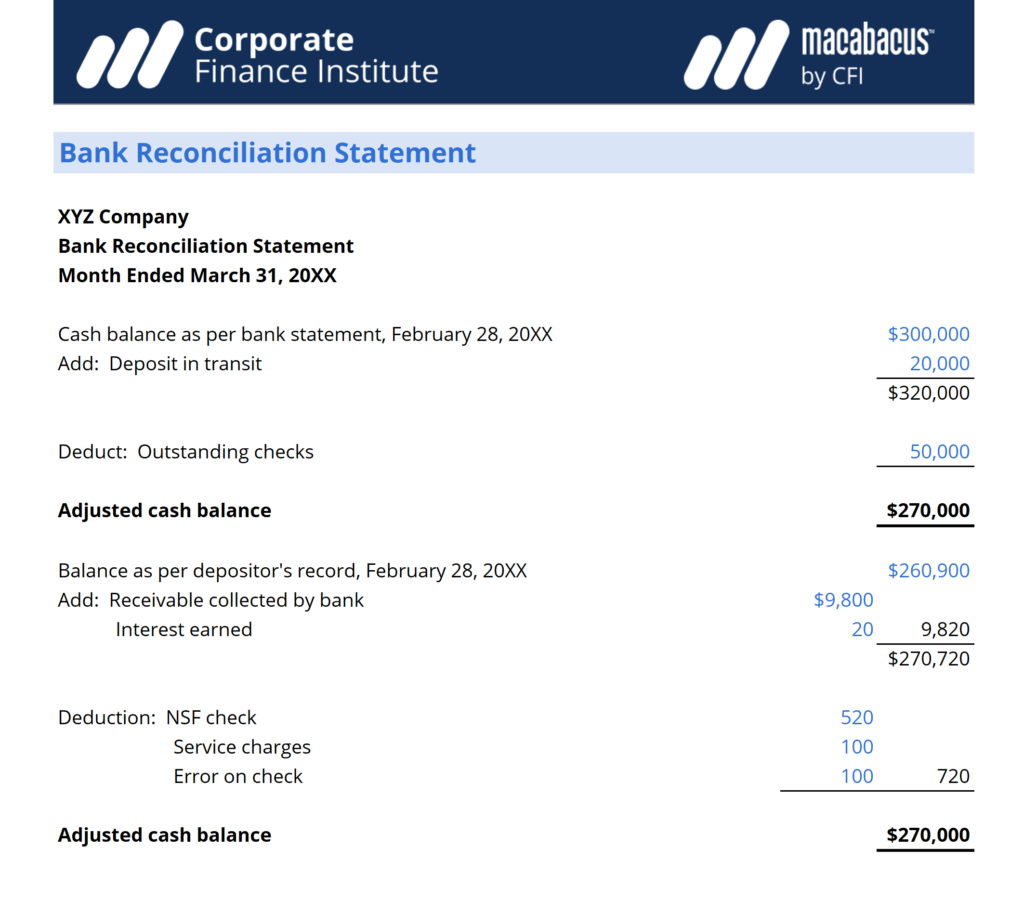

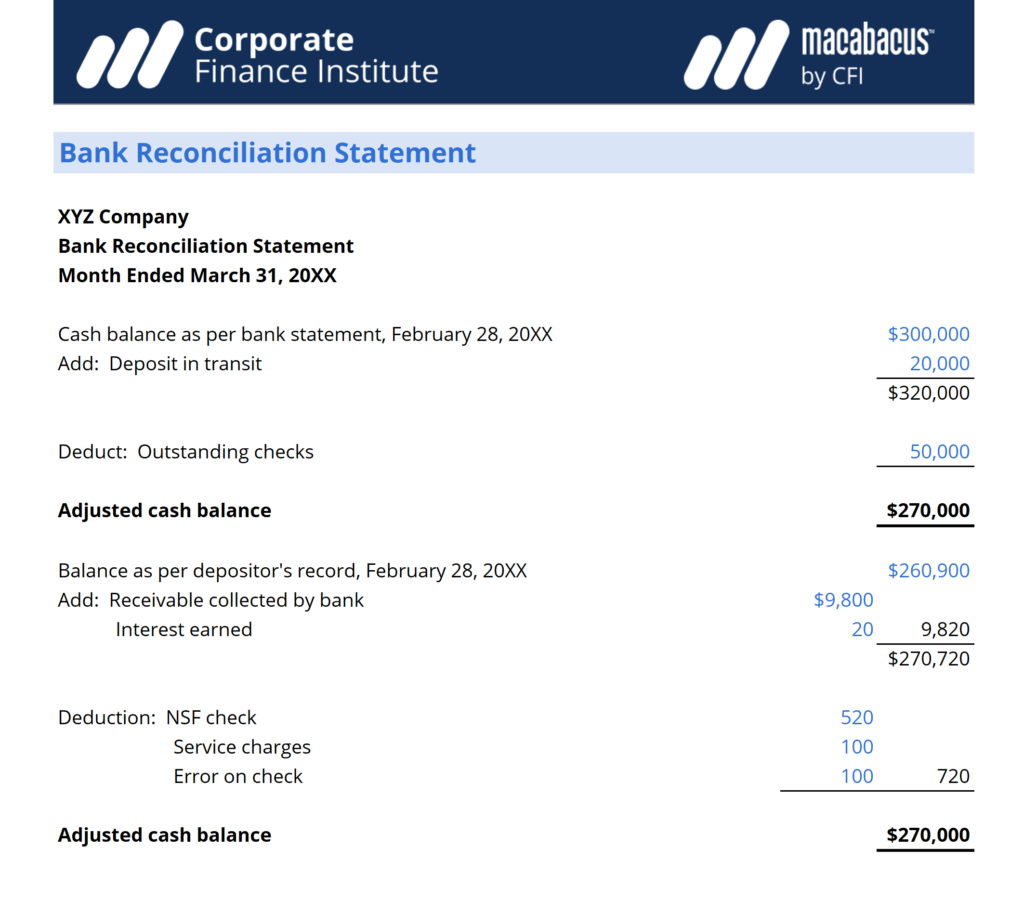

XYZ Company is closing its books and must prepare a bank reconciliation for the following items:

- Bank statement contains an ending balance of $300,000 on February 28, 2018, whereas the company’s ledger shows an ending balance of $260,900

- Bank statement contains a $100 service charge for operating the account

- Bank statement contains interest income of $20

- XYZ issued checks of $50,000 that have not yet been cleared by the bank

- XYZ deposited $20,000 but this did not appear on the bank statement

- A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370.

- A note receivable of $9,800 was collected by the bank.

- A check of $520 deposited by the company has been charged back as NSF.

| Amount | Adjustment to Books |

|---|

| Ending Bank Balance | $300,000 |

| Deduct: Uncleared cheques | – $50,000 | None |

| Add: Deposit in transit | + $20,000 | None |

| Adjusted Bank Balance | $270,000 |

| Ending Book Balance | $260,900 |

| Deduct: Service charge | – $100 | Debit expense, credit cash |

| Add: Interest income | + $20 | Debit cash, credit interest income |

| Deduct: Error on check | – $100 | Debit expense, credit cash |

| Add: Note receivable | + $9,800 | Debit cash, credit notes receivable |

| Deduct: NSF check | – $520 | Debt accounts receivable, credit cash |

| Adjusted Book Balance | $270,000 |

Bank Reconciliation Statement

After recording the journal entries for the company’s book adjustments, a bank reconciliation statement should be produced to reflect all the changes to cash balances for each month. This statement is used by auditors to perform the company’s year-end auditing.

Download Free Template

Enter your name and email in the form below and download the free template now!

Related Readings

Through financial modeling courses, training, and exercises, anyone in the world can become a great analyst. To keep advancing your career, the additional CFI resources below will be useful:

- 3 Statement Model

- Deposit Slip

- Financial Statement Normalization

- Financial Statements for Banks

- The Ultimate Cash Flow Guide

- See all accounting resources

Get Certified for Financial Modeling (FMVA)®

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.